Stories

Stories

July 4, 2024 • 4 min read

In Uganda, 400,000 young people compete for only 9,000 jobs annually. The country has one of the highest youth unemployment rates in sub-Saharan Africa, at 13.5%. Finding sustainable and dignified pathways out of poverty is an enormous challenge.

About the Markets for Youth Programme

GOAL is implementing the Markets for Youth Programme in partnership with the Mastercard Foundation. The five-year programme aims to enable 300,000 rural young women and men between 16-35 years to access dignified and fulfilling work by improving access to formal financial services. The programme works through private sector actors, including financial institutions like banks, input and output market actors, ICT solution providers, business development service providers and formal and informal training providers; Civil Society Organizations like Kabarole Research and Resource Center, and government institutions, including the District Local Government to achieve the following outcomes:

- Increased access and utilization of financial services and products.

- Increased access and utilization of skills training information.

- Increased access and utilization of inputs and output markets.

- Amplified youth voice and engagement.

- Through this facilitative approach, the Markets for Youth Programme ensures sustainable systematic change.

Learn more about the Markets for Youth programme.

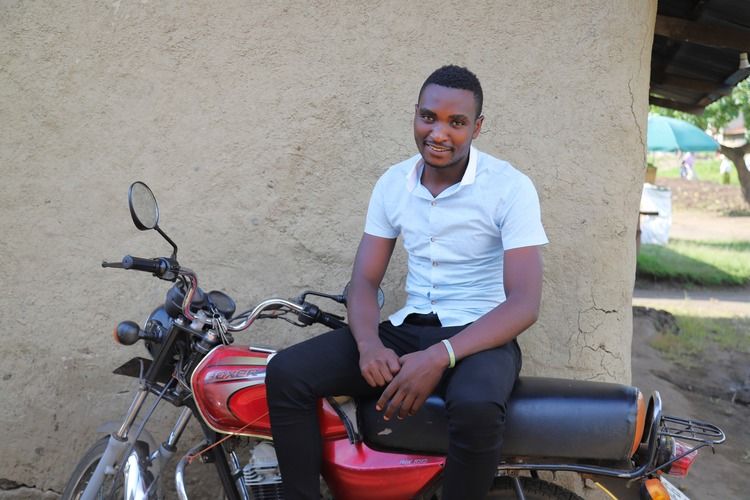

Edson, a young farmer and member of Kimya Youth Forum, who received support under the Markets for Youth programme.

Accessing Formal Financial Services

Samuel is a 26-year-old man who founded the Kimya Youth Forum in Kimya Village, Karabole District, Western Uganda. He dropped out of secondary school several years ago because he could not afford his school fees. In 2019, he created the 15-member forum with the sole goal of saving money. Since then, it has evolved into a thriving business.

Struck by the group’s commitment, subcounty officials introduced the group to the Karabole Research and Resource Centre (KRC Uganda), a civil society organisation specialising in capacity-building and advocacy.

Under the Markets for Youth Program, KRC Uganda initially offered Kimya Youth Forum group management training. “At first, we lost interest when KRC indicated that they would not be giving us any money, except for transport. But the vibrance and practicability of the training interested us,” Samuel explains.

The group accepted KRC Uganda’s support and was later connected to Centenary Bank, the Microfinance Support Center, and Equity Bank. These financial institutions offered the group financial literacy training, which included information on how to access loans as business capital.

Samuel with the motorbikes be purchased, thanks to the loan he received thanks to the Markets for Youth programme

Loans Transforming Youth-Owned Businesses

Samuel, who was baking and selling chapati (flatbread) for a living, secured a loan of UGX 1,500,000 (est. $400). Other group members also began accessing formal financial services. Francis received UGX 2,000,000 (est. $600) for his pool table business, while Hedson and Clovis, both farmers, received UGX 2,000,000 (est. $600) and UGX 3,000,000 (est. $ 1000) respectively.

Accessing formal financial services was a transformative opportunity for the Kimya Youth Forum. “Drawing from our example, people’s attitudes towards getting loans have positively changed in this village. Previously, people in this village thought that banks used loans to trap and take people’s property,” Samuel explains. “This is because people had previously witnessed property confiscation by banks due to failed loan payments.”

Samuel’s loan portfolio has grown to UGX 5,000,000 (est. $1500). He now owns three motorbikes, which he rents out for UGX 10,000 per day ($4). His chapati business has expanded and earns a profit of UGX 20,000 per day ($5). He is also the proud proprietor of a mobile money and banking business, earning him UGX 300,000 ($80) in commissions every month.

Samuel’s mobile money and banking business, which he opened thanks to support from the Markets for Youth programme

Dreams Fulfilled

He has since purchased a piece of land and is excited to build his own home and start a family. “It is unbelievable that we have come this far in a short while,” Samuel says, smiling. “Today, if you asked anyone in this village about me, they would tell you about a young man who is developing at a very fast speed.”

Meanwhile, Francis now owns a fully-fledged bar business, earning him a monthly profit of UGX 2,000,000 (est. $300). Edson owns two acres of farmland and rents five additional acres, generating a profit of UGX 800,000 (est. $250) every month, while Clovis is in the process of building a restaurant and accommodation for tourists.

Collectively, the group has rented two acres of land to farm maize and beans and generate additional profit. The Kimya Youth Forum hopes that the project will enable them to fulfil one of their biggest dreams: to acquire a piece of land and set up a permanent office for the group.

“When I think about the journey of the group members, I feel so much joy and pride because they are a vivid testimony of how the Kimya Youth Forum has saved lives by providing us with sustainable livelihood,” Samuel said. The Markets for Youth programme will continue to monitor and offer technical assistance to ensure the group’s success.

Support GOAL’s work in Uganda with a donation today.

Clovis in front of the combined restaurant and tourist accommodation that he is building, thanks to the support he received under the Markets for Youth programme.